Long

Commercial names

Leva fissa, Constant Leverage, Faktor, Daily Leverage

Characteristics:

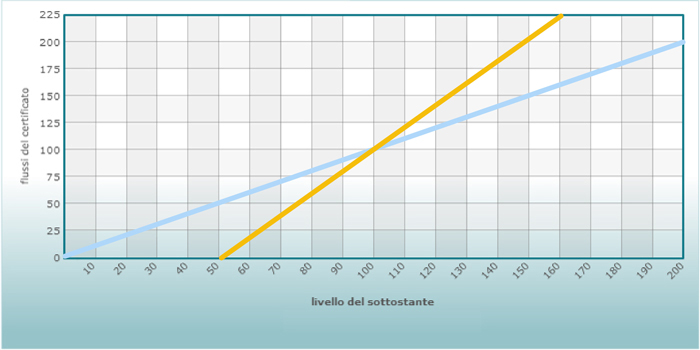

- Full replication of the underlying asset’s performance with constant leverage

Return profiles

| Maturity | 4 - 5 year |

| Investment horizon | short term |

| Aim | to profit from positive performances of the underlying asset with a constant leverage effect |

| Strategy | bullish (at issue and during life onf product) |

| Capital protection at maturity/Risk | no protection |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

| Variables | Issue | Barrier** | Life residual*** |

Commercial names

Leva fissa, Constant Leverage, Faktor, Daily Leverage

Characteristics:

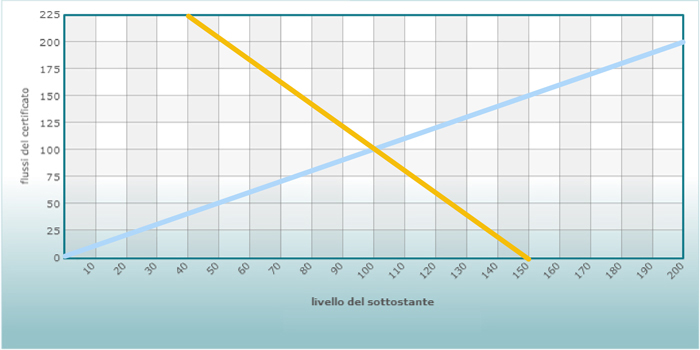

- Full replication of the underlying asset’s performance with constant leverage

Return profiles

| Maturity | 4 - 5 years |

| Investment horizon | short term |

| Aim | to profit from the negative performances of the underlying asset |

| Strategy | bearish |

| Capital protection at maturity/Risk | no protection |

Lean more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

| Variables | Issue | Barrier** | Life residual*** |